Silver trading is of great significance to Indian investors. Historically and culturally, silver holds deep value in India. It offers diversification benefits, acting as a hedge in times of market volatility. Industrial demand plays a crucial role in various sectors. As a safe-haven asset, it safeguards against economic uncertainty. Silver also acts as an effective inflation hedge. Moreover, the silver market provides ample trading opportunities, allowing investors to capitalize on price fluctuations. Overall, silver trading is a valuable avenue for preserving wealth and achieving financial goals in the Indian context.

Trading indicators are essential tools for investors. They are mathematical calculations based on price, volume, or open interest, providing insights into market trends and potential buy or sell signals. These indicators help traders make informed decisions, manage risks, and enhance their trading strategies.

Silver trading is highly relevant for Indian investors due to its cultural significance, potential for diversification, and effectiveness as an inflation hedge. It offers a unique opportunity to preserve wealth and manage risk in the dynamic Indian financial landscape.

Understanding Silver Trading

Silver trading involves buying and selling silver as a commodity. In India, major commodity exchanges like MCX and NSE facilitate this trade. Investors can engage in spot, futures, or options contracts, depending on their risk appetite and investment horizon.

Supply and demand dynamics, industrial usage, geopolitical events, and currency fluctuations influence silver prices. Keeping an eye on these variables is vital for making informed trading decisions.

Trading Hours: Silver trading in India typically occurs from Monday to Friday, with morning and evening sessions catering to different market participants. Understanding these trading hours is crucial for timing trades effectively.

Emotions can play a significant role in trading outcomes. Maintaining discipline and emotional control is essential to avoid impulsive decisions.

Why Use Trading Indicators?

Trading indicators are crucial in making informed decisions by providing objective data and insights into market trends. These mathematical calculations, derived from price, volume, or open interest, help traders assess market conditions, identify potential entry and exit points, and manage risks. By offering quantifiable signals and patterns, indicators reduce subjectivity, allowing traders to base their decisions on empirical evidence rather than emotions. They are essential tools for evaluating market sentiment, confirming price movements, and developing trading strategies. Ultimately, trading indicators empower traders to make well-informed decisions, enhancing their ability to navigate financial markets effectively.

Exponential Moving Average (EMA) indicators are valuable tools for identifying entry and exit points in trading. For entry, EMAs provide swift responses to recent price changes, offering traders early signals when a short-term EMA crosses above a longer-term EMA, signifying a potential uptrend, or when it crosses below, indicating a possible downtrend. This assists traders in entering positions at advantageous moments. For exits, EMAs help pinpoint when a trend is losing momentum, as the EMA line begins to flatten or cross the price in the opposite direction. Traders use these cues to exit positions profitably or minimize losses, allowing for well-timed and informed trading decisions.

Types of Silver Trading Indicators

Trend Indicators:

These indicators help traders identify the direction of the silver price trend. Common examples include Moving Averages (SMA and EMA) and the Directional Movement Index (DMI).

Volatility Indicators:

These indicators measure the degree of price volatility in the silver market. Bollinger Bands and Average True Range (ATR) are popular tools for assessing volatility.

Momentum Indicators:

Momentum indicators evaluate the strength and speed of price movements. The Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), and the Stochastic Oscillator are widely used in silver trading.

Volume Indicators:

Volume indicators, like On-Balance-Volume (OBV) and Chaikin Money Flow, help traders gauge the trading volume associated with silver price movements, aiding in confirming trends and reversals.

Support and Resistance Indicators:

These indicators identify key price levels where silver is likely to encounter support (price floor) or resistance (price ceiling). Pivot Points and Fibonacci retracement levels fall into this category.

These various types of indicators provide traders with diverse tools and perspectives to analyze the silver market, make informed decisions, and develop effective trading strategies.

Setting Up a Silver Trading Strategy

A popular silver trading strategy involves using Exponential Moving Averages (EMA). The Basic thing that you know is that when the short-term EMA crosses below the long-term EMA, it triggers a sell signal. This indicates a weakening trend and signals an exit point to sell or liquidate silver holdings. By using this EMA crossover strategy, traders aim to capture trends and make well-timed decisions in the dynamic silver market.

Indicator Add & Set-up on TradingView Platform:

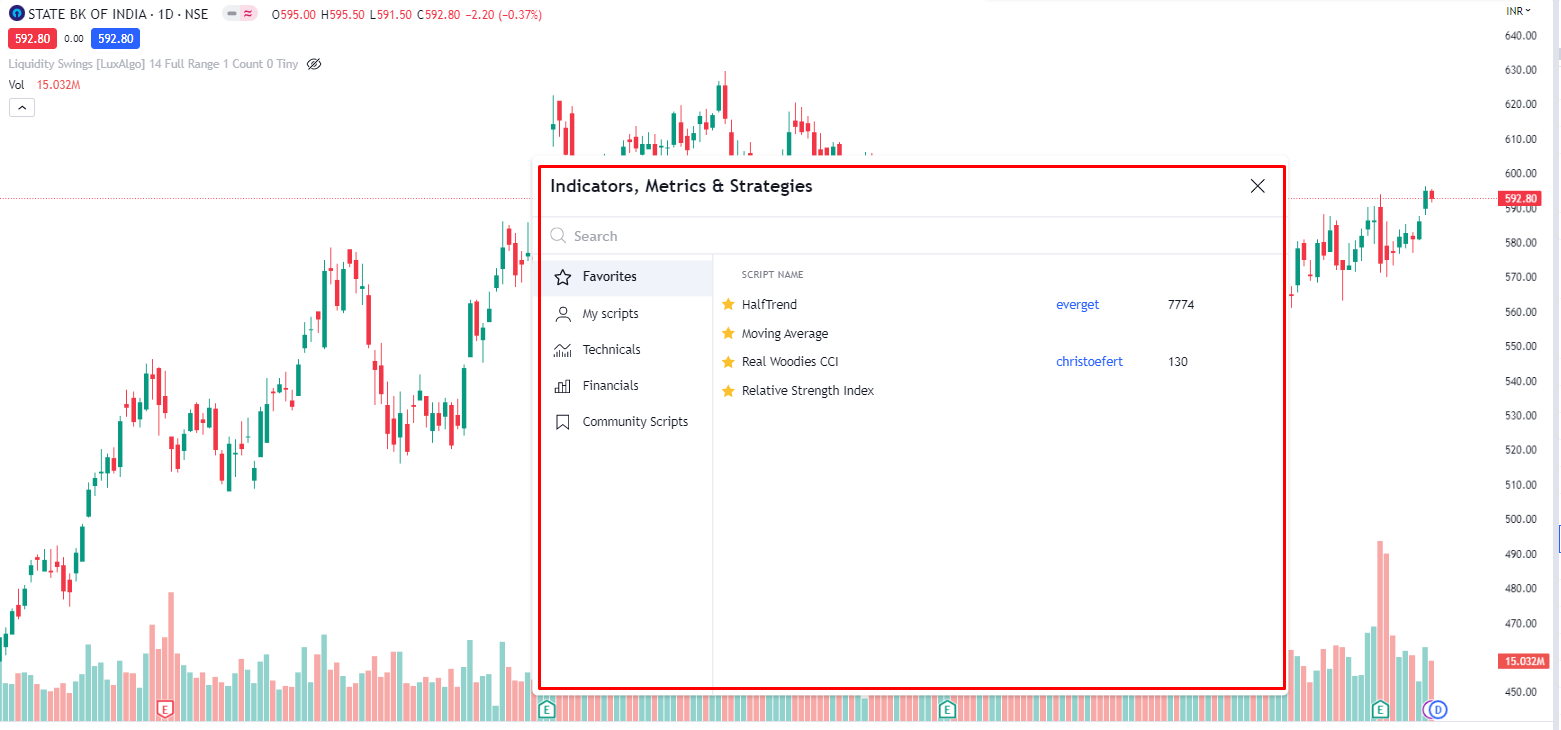

To add the “Multiple EMA 34” Indicator to the TradingView platform, you can follow these steps:

Open the TradingView platform and navigate to the chart you want to apply the “Multiple EMA 34” Indicator.

Click on the “Indicators” button located at the top of the chart. It looks like a beaker icon.

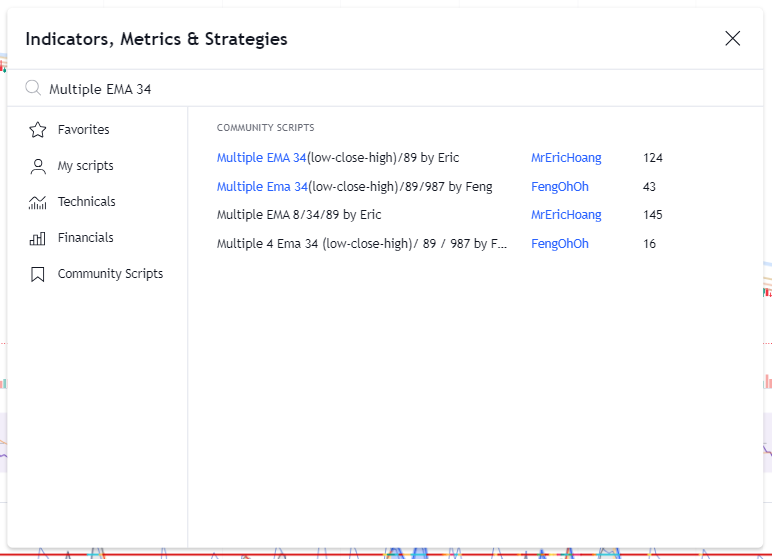

In the search bar that appears, type “Multiple EMA 34” and select the “Multiple EMA 34(low-close-high)/89 by Eric” indicator, author MrEricHoang.

Now can you change any color combination as per your view and do not need to change any value on the settings panel. Click on settings and follow the below pictures for your reference.

Now, click OK and come to the important points for silver trading.

Understand the Multiple EMA 34 indicator

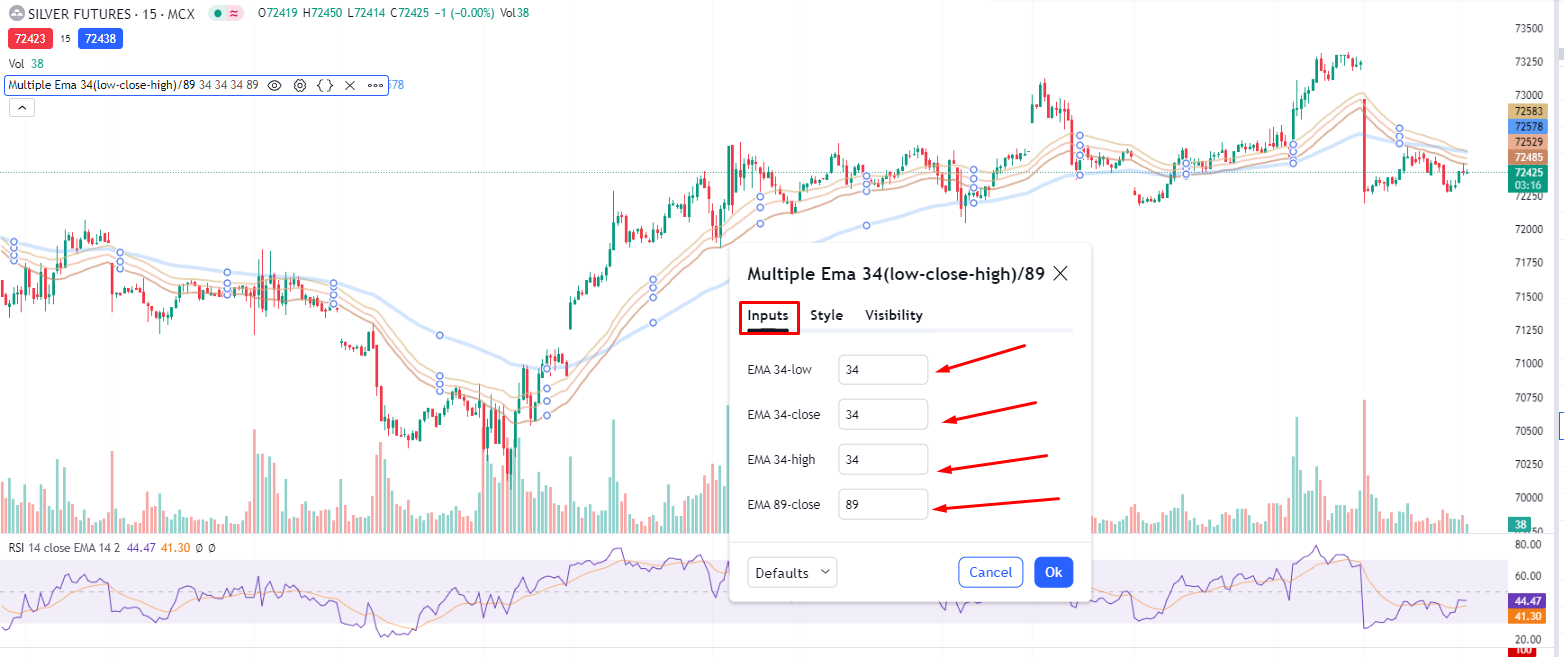

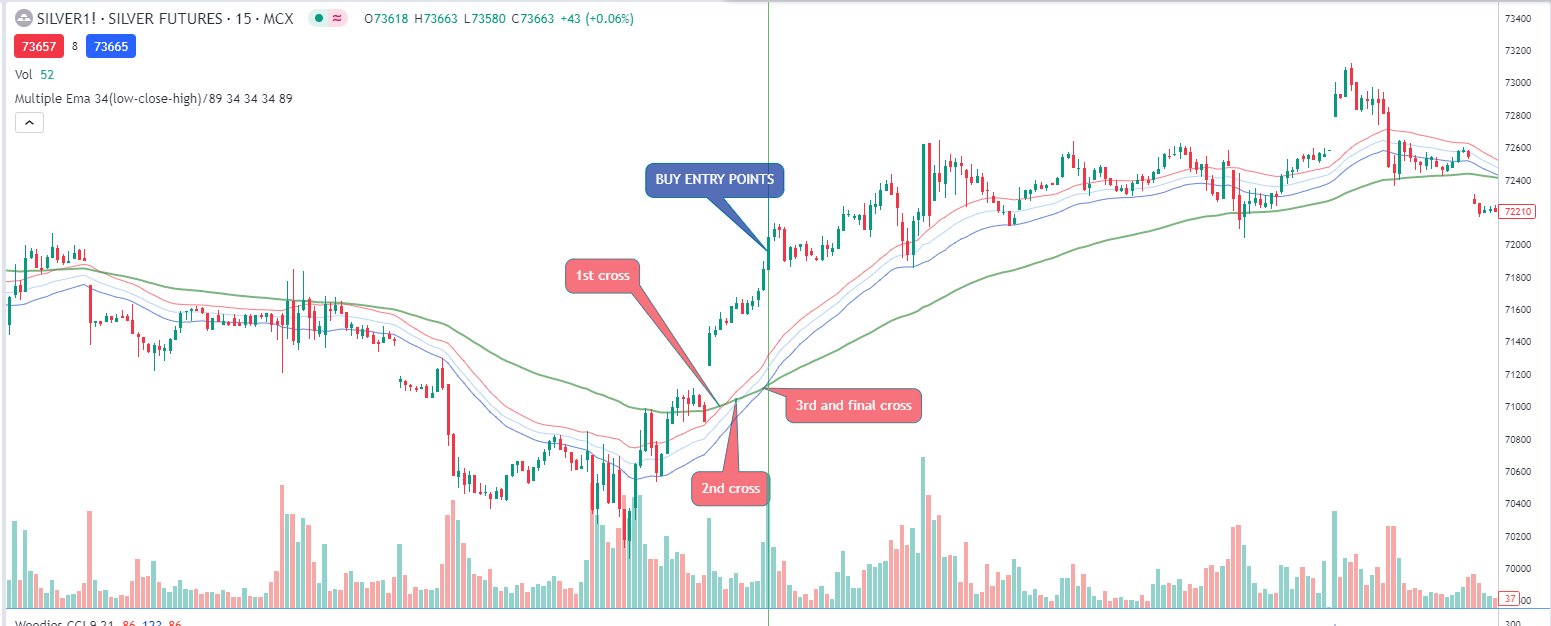

This is a completely personalized trading strategy for silver trading. Here is one thing you must know; the minimum time frame will be 15 minutes and not less than the same. Whenever you are trying to use a lower time frame value chart, it will be much too messy for trading. So, use 15 minutes, 30 minutes, 60 minutes or a bigger time frame. Now let’s check out the silver chart.

Here, in this indicator, you can see the higher EMA (Close) which is valued at 89 (Sky blue color) as marked in the above picture. Three parallel lines are based on EMA 34 which are valued for High Low & Closing as mentioned in the above picture.

Personalized Trading Strategy

So, All set. Our Indicator & our chart is read to find the trend. Now we have to find the entry point for specific silver trading. The Rule is Simple for every trader. You just need to cross the 3 lines completely on EMA 89. Please check the below picture for reference. This is for buy and sell also.

Stop Loss & Target Setup

The two best ways to put the stop loss of this silver trading strategy. The first one is to put your stop loss to the last low (for buy) or last high (for sell). Which will be little much higher ratio than your target. If you follow this method then on a revised basis stop loss you can get maximum profit from your sweet silver trading. Check out the levels for your 1st method as a reference.

Here, I am not mentioning any target for your trade because you have to revise your stop loss as per trend. The positive thing about this method is you can earn more points which can possibly be up to 3-5% as per holding pattern, or you can say carry forward trade.

Here also have some twists. No overconfidence is required.

Before the top high (for Sell) is triggered, if it again crosses the 3 lines, then you must have to close the trade. Please check the reference for a better understanding. No need to panic about loss.

Look at the Next trend which was sold @ 73801 level.

BOOM !!!

One single trade can give you 4000 points, and it’s happened. So, Don’t worry about your stop loss.

The final line for the 1st silver trading method is “Stop loss will be last low or full 3 EMA lines crossover, whichever is earlier.”

Understand the rules and use it on your demo account first and then use it on your Real-time account if you are comfortable with it.

For more content, you can check here.

You can follow my social platforms here.

500+ YouTube content. You can subscribe for more live content here.

2200+ Twitter Posting on live proof here.

Follow the Facebook page for updates.