In this comprehensive guide, we will explore the best strategies and techniques to help you catch a stock on the bottom in 2023. As clever investors, we understand the importance of timing and maximizing our investment potential. By utilizing the right tools and adopting a well-informed approach, we can position ourselves for success in the stock market.

Understanding the Bottom

Before diving into the strategies, it is crucial to understand what we mean by “catching a stock on the bottom.” The term refers to identifying the favorable entry point for a stock when it reaches its lowest price before rebounding. By investing at the bottom, you have the potential to gain significant profits as the stock value rises.

Conduct Thorough Research

The key to successfully catching a stock on the bottom lies in conducting thorough research. Knowledge is power, and staying informed about market trends, industry news, and specific companies is essential. Here are some effective research strategies:

- Fundamental Analysis to catch a stock on the bottom

Performing a fundamental analysis involves evaluating a company’s financial health, management team, competitive advantage, and growth potential. Dive deep into financial statements, annual reports, and news releases to gain insights into a company’s fundamentals which can help you to catch a stock on the bottom. - Technical Analysis to catch a stock on the bottom

Utilize technical analysis to identify patterns and trends in stock price movements. Analyze charts, indicators, and historical data to understand the stock’s behavior. This approach can help you identify potential entry points and when to catch a stock on the bottom. - Stay Updated with Market News

Keep a close eye on market news and developments that can impact stock prices. News about regulatory changes, earnings reports, new product launches, or major partnerships can significantly influence stock prices. Being aware of these events can help you time your entry accurately.

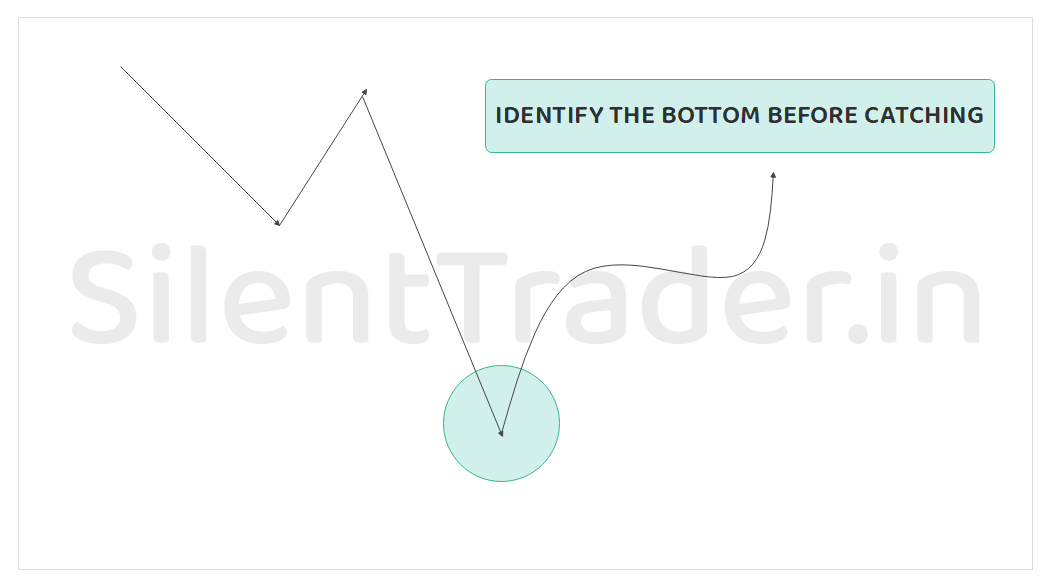

Timing is Crucial

Timing is everything when it comes to catching a stock on the bottom. Here are a few strategies to help you identify the right time to make your move:

- Patience is Key

Instead of rushing into investments, exercise patience and wait for the opportune moment. Markets go through cycles, and stocks experience fluctuations. By observing and waiting for the right time, you increase your chances of entering at the bottom. You can see the below chart where you can see the price trading in the parallel channel. I am not mentioning the 8015 & 7524 levels to buy or enter. After making this pattern we identify the pattern and point. But during that time you got two points which were 8015 & 7524 and then you can get the 7282 area if you add this parallel channel and extend it. That means if you had the patience then you can have an opportunity to enter the point at Rs. 7280 area. If you can then the next target was near 1100 points.

- Dollar-Cost Averaging

Consider implementing a dollar-cost averaging strategy. This approach involves investing a fixed amount of money at regular intervals, regardless of the stock’s price. By doing so, you purchase more shares when the price is low and fewer when the price is high, ultimately averaging out your investment. - Monitor Support Levels

Pay close attention to support levels, which are price levels where a stock tends to find buying interest and resist falling further. By studying historical price charts, you can identify these levels and plan your entry accordingly.

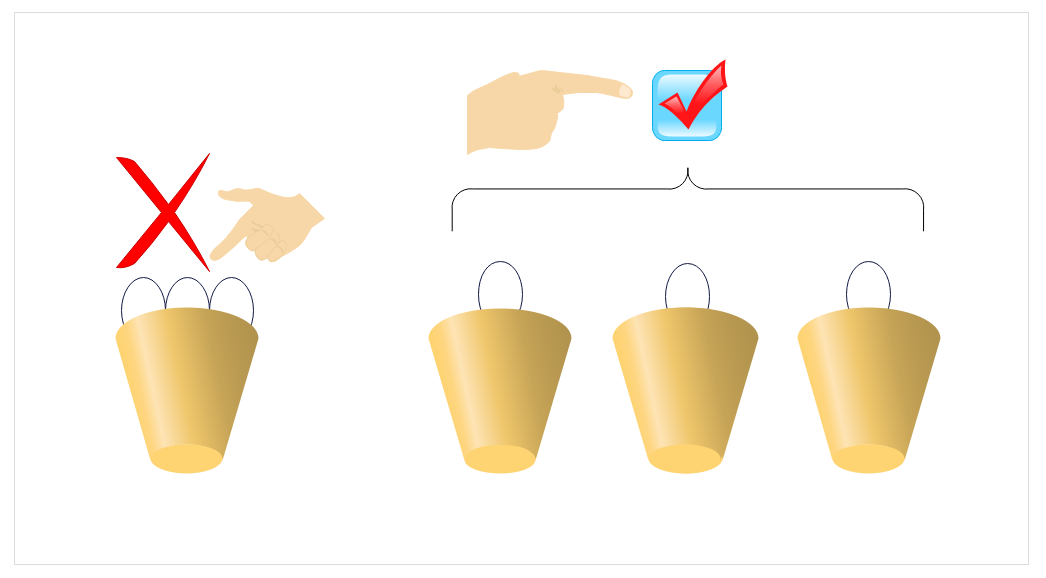

Diversification and Risk Management

Diversification and risk management are crucial components of any successful investment strategy. Here’s how you can incorporate them when catching a stock on the bottom:

Spread Your Investments

Avoid putting all your eggs in one basket. Diversify your portfolio by investing in multiple stocks from different industries. This helps mitigate risk by spreading your investments across various sectors.

Set Stop-Loss Orders

To protect yourself from significant losses, consider setting stop-loss orders. These orders automatically sell a stock if it reaches a predetermined price. By doing so, you limit your potential losses if the stock doesn’t perform as expected.

Stay Informed and Adapt

Keep yourself updated on market conditions and adapt your investment strategy accordingly. If you notice a significant change in the market or the stock you’ve invested in, be willing to adjust your approach to minimize risk and maximize potential gains.

Conclusion

Catching a stock on the bottom requires a combination of in-depth research, careful timing, and effective risk management. By following the strategies outlined in this article, you’ll be better equipped to identify promising investment opportunities and maximize your chances of success in the stock market.

Remember, investing always carries risks, and it’s essential to conduct your due diligence and consult with financial professionals before making any investment decisions.

In the next session, we will discuss how to catch the stock at the bottom with the help of a Technical chart and tools.

For more content, you can check here.

You can follow my social platforms here.

500+ Youtube content. You can subscribe for more live content here.

2200+ Twitter Posting on live proof here.

Follow the Facebook page for updates.