This content aims to conduct a comparative analysis of stop loss strategies by investigating if the stop loss strategies outperform the buy-and-hold strategies. The trailing tests the performance of stop loss strategies stop loss where a stock is sold if the price reaches a certain percentage below the highest prices since the starting date. The tested stop loss strategies are 10%, 15%, 20%, 25% and 30% stop loss strategies. The stop loss strategies perform more effectively and consistently when it comes to minimizing stock return variances The study therefore recommends the application of stop loss strategies to a stock portfolio to minimize losses, especially during market downturns.

Stop Loss Strategy

A stop loss strategy is recommended by specialists to limit losses in declining stocks by automatically selling them at a predetermined price. It helps overcome behavioral biases and realize losses sooner. While promoted for improving portfolio performance, stop loss strategies may not always be efficient. They fail to incorporate new information if returns are predictable, and don’t guarantee better outcomes if returns are unpredictable. Two types exist: trailing stop loss, adjusting with price changes, and regular stop loss, set at a fixed percentage. Trailing stop loss offers flexibility, protecting capital in price drops and allowing profit protection as prices rise. Despite practitioner acceptance, academics debate its efficacy compared to buy-and-hold or more active strategies.

Relationship between Stop Loss and Buy and Hold Strategies

Stop loss and buy and hold strategies are utilized in portfolio management. A stop loss strategy involves exiting positions to minimize losses or secure gains, while buy and hold focuses on long-term performance assessment. Value investors typically employ buy-and-hold, employing diverse systems to determine investment timing. In contrast, stop loss strategies facilitate emotion-free decision-making. They enable investors to cut losses and lock in profits without being swayed by emotions. While buy-and-hold emphasizes patience and long-term growth, stop loss strategies prioritize risk management and timely action. Both approaches serve distinct purposes: buy-and-hold for sustained growth and stop loss for mitigating downside risk. Investors often blend these strategies to balance long-term objectives with risk control, leveraging the strengths of each method for a well-rounded portfolio management approach.

Research Problem

The debate over the efficiency of stop loss versus buy-and-hold strategies holds significant implications for the market, investors, and financial theory. It reflects a choice between Efficient Market Theory and Behavioral Finance/Technical Analysis. Statistical evidence suggests that stop loss strategies may add value when prices exhibit trends but may be inefficient with random walk or mean-reversion patterns.

Technical Research Problem

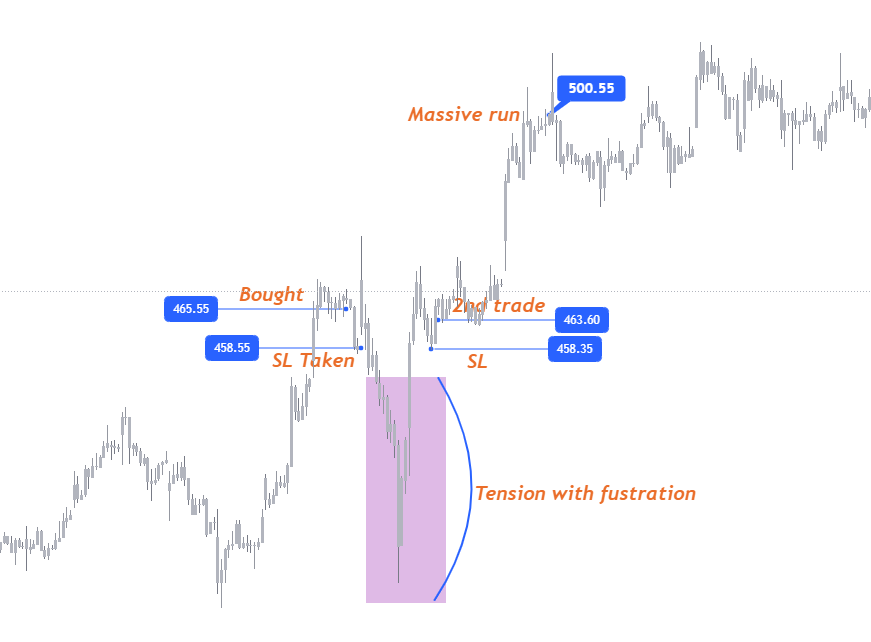

The technical research problem regarding stop loss strategies revolves around determining their effectiveness in mitigating losses and optimizing investment returns. Specifically, the study aims to investigate how various technical indicators, such as moving averages, relative strength index (RSI), or Bollinger Bands, can be utilized to implement stop loss orders effectively. This involves examining historical price data to identify patterns or trends that signal potential exit points for stop loss orders. The real and major problem was whenever we put a stop loss on the market using Moving Average, a spike low takes the stop loss and reverse back from the lower level.

The research seeks to address several key questions, including the optimal placement of stop loss orders based on technical indicators, the impact of different market conditions (e.g., volatility, trend direction) on stop loss effectiveness, and the comparison of various technical indicators in terms of their predictive power for stop loss placement.

Additionally, the study may explore the integration of technical analysis with other factors, such as fundamental analysis or market sentiment, to enhance the accuracy of stop loss strategies. By addressing these research questions, the study aims to provide insights that can help investors make more informed decisions when implementing stop loss orders in their trading or investment strategies.

Stop loss is the Successful Icon

10 to 20 years before the current year, Stop loss was very much technical because of its reality. What I mean to say some logic can save your stop loss without touching the line. Before hitting the stop loss you get the profit points very easily. Why its happen? The actual reason was that low investor & trader activity. Nowadays, traders and investors are fully active with huge funds. A spike low can trigger your stop loss level or may be breaking the level. Stop loss is best for all traders and investors because of fund management. YES !!!

If you trade on the options market, then put your stop loss strictly and must exit at the point where you think that there are no points to hold. Maybe it can pull back from the stop loss level but it’s a probability percentage that is too much low. If you exit the position on the stop loss level, there are some benefits –

- You will save your money

- You can trade more from the rest money

- You have an opportunity to take the next trade

- You can balance your trading phycology

- Opportunity to re-think your mistake

- Proper money management

Conclusion

As a trader and investor, always use the stop loss level to exit before it damages your fund balance. Any ignorance can affect your trading pattern and mind also.

For more content, you can check here.

You can follow my social platforms here.

500+ YouTube content. You can subscribe for more live content here.

2200+ Twitter Posting on live proof here.

Follow the Facebook page for updates.