Introduction

Stock SIP vs Mutual Fund SIP is a special topic to know for your investment where you can see the difference between the return of your investment. In today’s fast-paced financial world, Systematic Investment Plans (SIPs) have become a popular way to invest regularly without the hassle of timing the market. But what exactly is an SIP, and more importantly, how do Stock SIPs differ from Mutual Fund SIPs? This article dives deep into both types of SIPs, helping you decide which one is best suited to your financial goals and risk appetite.

What is an SIP?

Defining Systematic Investment Plans

A Systematic Investment Plan, commonly known as SIP, is a method of investing a fixed sum of money at regular intervals (monthly, quarterly, etc.) into an investment instrument. The most common SIPs are tied to mutual funds, but SIPs can also be used to invest directly in stocks.

SIP’s Growing Popularity in India

Over the last decade, SIPs have seen a massive surge in popularity, especially among young and first-time investors like you. The reason? SIPs make investing disciplined, affordable, and convenient. Instead of making lump-sum investments, you gradually build a corpus by consistently investing small amounts.

What is a Stock SIP?

Understanding Stock SIPs

A Stock SIP allows investors / you to invest in individual stocks instead of mutual funds. In a Stock SIP, you decide which stocks to buy and in what quantity, regularly purchasing shares over time.

Key Features of Stock SIPs

- Direct investment in specific stocks.

- Control over your stock selection.

- Ideal for experienced investors who want hands-on control.

What is a Mutual Fund SIP?

Defining Mutual Fund SIPs

In a Mutual Fund SIP, your regular investments go into a mutual fund scheme managed by professional fund managers. These funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Key Features of Mutual Fund SIPs

- Managed by professionals.

- Diversified investment portfolio.

- Best suited for beginners or those seeking a passive investment route.

Differences Between Stock SIP and Mutual Fund SIP

Risk Factors

Stock SIPs involve direct exposure to individual stocks, making them riskier, especially if you choose volatile stocks. On the other hand, Mutual Fund SIPs come with built-in diversification, reducing risk.

Returns Comparison

While Stock SIPs can potentially offer higher returns if you pick the right stocks, they also carry a higher risk. Mutual Fund SIPs, being diversified, usually provide more stable returns over time, though typically lower than high-performing individual stocks. For the return ratio chart, you will see it in the last section.

Investment Management

Stock SIPs require you to actively monitor and adjust your portfolio, whereas Mutual Fund SIPs are managed by professionals, making them ideal for investors who don’t want to be involved in day-to-day market tracking.

Ease of Investment

Mutual Fund SIPs are much easier to set up and manage, especially for beginners, whereas Stock SIPs require a certain level of expertise and market knowledge.

Benefits of Stock SIP

Direct Control Over Investment

In a Stock SIP, you have full control over which stocks to buy and how much to invest. This appeals to investors who prefer to make their own decisions.

Flexibility in Stock Choices

You can choose from a wide variety of stocks across sectors, allowing you to tailor your portfolio to your preferences and market outlook.

Higher Growth Potential

If you pick the right stocks, Stock SIPs can yield higher returns compared to Mutual Fund SIPs. Stocks of companies in growing sectors can generate significant capital appreciation over time.

Benefits of Mutual Fund SIP

Professional Fund Management

Mutual Fund SIPs are managed by experts with the resources to conduct in-depth market research. This takes the burden of constant monitoring off your shoulders.

Diversification

Your investment is spread across multiple assets, reducing risk and ensuring a balanced portfolio, even if some assets underperform.

Suitable for Beginners

Since mutual funds are managed by professionals and are well-diversified, they are ideal for novice investors who may not have the time or knowledge to select individual stocks.

Who Should Choose Stock SIP?

Ideal for Experienced Investors

Stock SIPs are best suited for investors who have a sound understanding of the stock market and can identify promising companies for long-term investment.

Suitable for Investors with Risk Appetite

If you’re willing to take on more risk for the potential of higher returns, Stock SIPs may be the right choice.

Who Should Choose Mutual Fund SIP?

Best for New and Passive Investors

Mutual Fund SIPs are ideal for investors who are either new to investing or prefer a hands-off approach. The professional management and diversification make this option safer for those who don’t want to take on high levels of risk.

Suitable for Conservative Investors

If you prioritize capital preservation over high returns, Mutual Fund SIPs, particularly debt or balanced funds, offer more conservative investment options.

Cost Structure Comparison

Fees and Charges in Stock SIPs

Stock SIPs usually come with brokerage fees every time you buy stocks. These fees can add up, particularly if you’re investing frequently.

Fees and Charges in Mutual Fund SIPs

Mutual Fund SIPs typically charge an expense ratio, which is a percentage of your total investment. This covers management fees and other operational costs, but it tends to be lower than the active trading costs in Stock SIPs.

Taxation on Stock SIP vs Mutual Fund SIP

Tax Implications for Stock SIP

Capital gains from Stock SIPs are taxed based on the holding period. Short-term gains (held less than 1 year) are taxed at 15%, while long-term gains (held more than 1 year) over ₹1 lakh are taxed at 10% (May be deferred when you verify it from your current TAX slab).

Tax Implications for Mutual Fund SIP

For Mutual Fund SIPs, taxation varies depending on the type of fund (equity or debt) and the holding period. Equity mutual funds have similar tax rules to stocks, while debt funds are taxed differently, with higher long-term capital gains taxes (May be deferred when you verify it from your current TAX slab).

How to Start with Stock SIP

Steps to Set Up a Stock SIP

- Open a Demat and trading account.

- Select the stocks you want to invest in.

- Decide the frequency and amount of your investments.

- Set up automated investments through your brokerage account.

Choosing the Right Stocks for SIP

Focus on fundamentally strong companies with consistent growth potential. Stocks from diverse sectors can also help reduce risk.

How to Start with Mutual Fund SIP

Steps to Set Up a Mutual Fund SIP

- Open an account with a mutual fund distributor or directly through the AMC (Asset Management Company).

- Choose a mutual fund scheme based on your risk profile.

- Decide the SIP amount and tenure.

- Set up the SIP with your bank or fund house.

Choosing the Right Mutual Funds

Consider funds with a strong track record, good management, and a portfolio that aligns with your investment goals (e.g., equity funds for growth, debt funds for stability).

Common Mistakes to Avoid in Stock and Mutual Fund SIPs

Emotional Trading

Avoid making decisions based on market sentiment. Both Stock and Mutual Fund SIPs are long-term investment strategies, and emotional decisions can derail your progress.

Lack of Research

For Stock SIPs, it’s crucial to research the companies you’re investing in. Similarly, for Mutual Fund SIPs, understanding the fund’s strategy and portfolio is key to making informed decisions.

Conclusion

When it comes to Stock SIP vs Mutual Fund SIP, there’s no one-size-fits-all answer. Stock SIPs offer higher control and growth potential but come with greater risk, while Mutual Fund SIPs provide professional management and diversification, making them ideal for beginners and conservative investors. Your choice should depend on your investment goals, risk tolerance, and expertise.

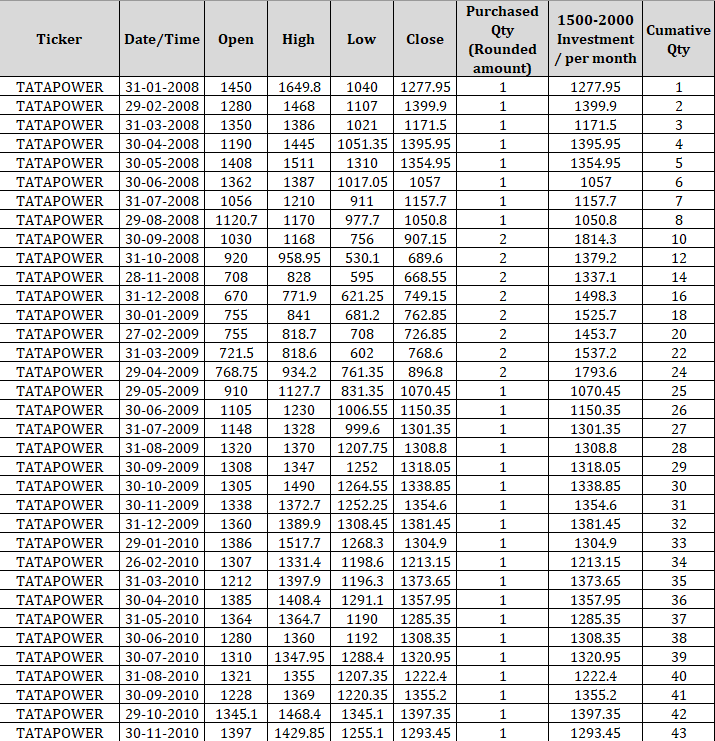

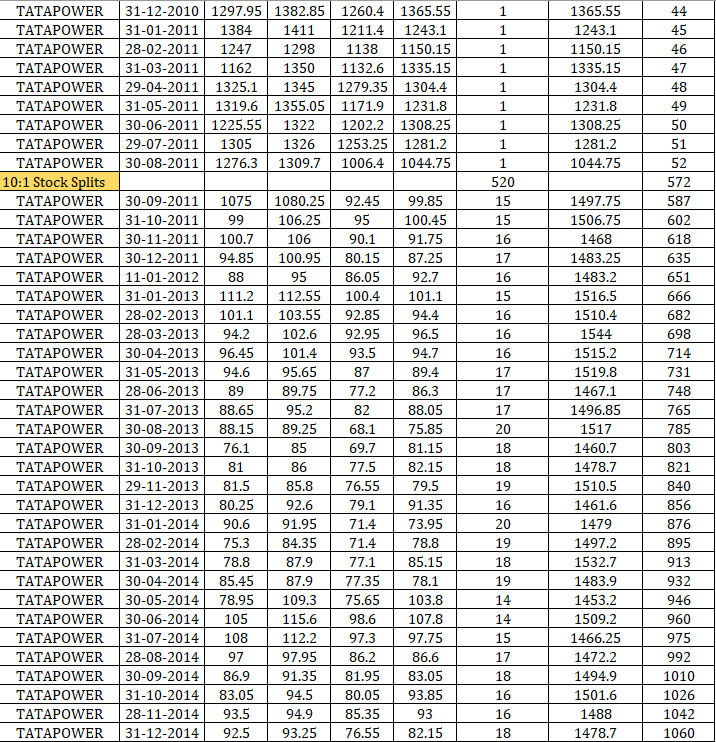

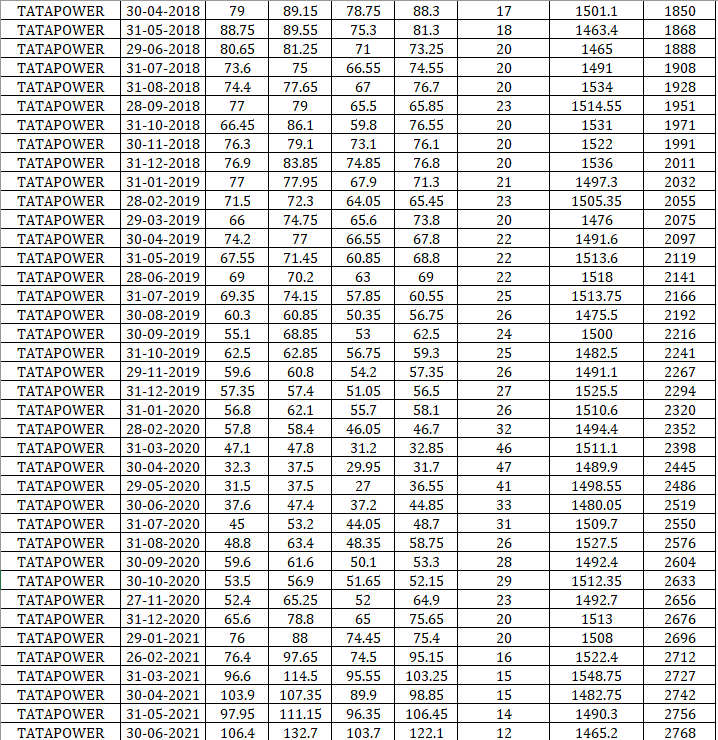

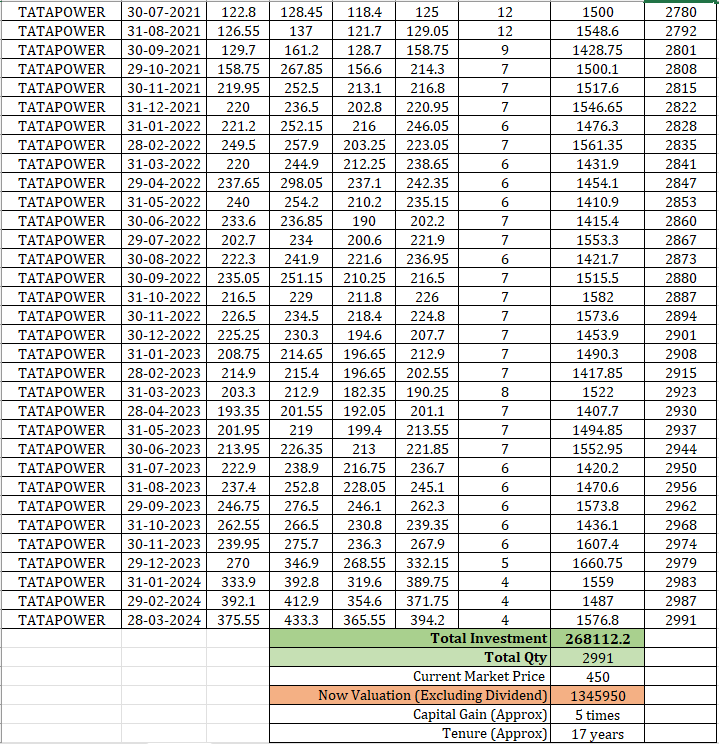

Stock SIP Return Glims

Here if you look very carefully, the average investment value per month is Rs. 1457.00. So, till March 2024 from Jan 2008, its investment amount is 2.68 lakh and now the valuation is near 13.45 lakh. Only One stock can give you this type of return. Just go and find out the best stock for the best return.

FAQs

What is better for beginners: Stock SIP or Mutual Fund SIP?

For beginners, Mutual Fund SIPs are a better option due to professional management and diversification.

Can I switch from Mutual Fund SIP to Stock SIP?

Yes, you can switch, but keep in mind that Stock SIPs require more knowledge and active management.

What is the minimum investment amount for both types of SIPs?

Mutual Fund SIPs typically have a minimum amount of ₹500 per month, while Stock SIPs vary depending on the price of individual stocks.

How often should I review my SIP investments?

You should review your SIPs at least once a year or if there are significant changes in the market or your personal financial situation.

What are the risks involved in Stock SIP compared to Mutual Fund SIP?

Stock SIPs are riskier as they depend on individual stock performance, while Mutual Fund SIPs are diversified, reducing overall risk.

Let’s start investing today and consult your financial advisor for a better proposal.

For more content, you can check here.

You can follow my social platforms here.

500+ YouTube content. You can subscribe for more live content here.

2200+ Twitter Posting on live proof here.

Follow the Facebook page for updates.