In trading, success chart time frame often depends on two crucial factors: how long you hold your trade (holding time) and where you set your target. These decisions can make or break a trade, especially when combined with the proper chart time frame. Whether you are a beginner or a seasoned trader, understanding how to calculate holding time and target according to the chart time frame is essential to developing a winning strategy.

But why is this so important? Simply put, the chart time frame you choose provides a context for how you view price action and helps determine your trade duration. Let’s break down how to align your holding time and target with your chart time frame for maximum profitability.

What is Holding Time in Trading?

Holding time refers to how long a trader keeps a position open in the market before closing it, whether it results in a profit or a loss. The duration of holding a position depends on various factors, such as the type of trading strategy, market conditions, and the trader’s goals.

Key Factors Affecting Holding Time:

- Trading Style: Scalpers, day traders, swing traders, and position traders all have different holding periods based on their strategies.

- Market Conditions: Volatile markets may require shorter holding periods, while calmer markets may allow for extended trades.

- Risk Tolerance: Traders with higher risk tolerance may hold trades longer to capture larger moves, while more risk-averse traders might close positions sooner.

Understanding Target Setting in Trading

A target in trading refers to the predetermined price level at which a trader plans to close a position and realize a profit. Setting a clear target ensures disciplined trading and prevents emotional decision-making.

Different Methods of Setting a Target:

- Technical Analysis: Using indicators like Fibonacci retracement, support and resistance, or trend lines to identify potential price levels.

- Fundamental Analysis: Setting targets based on market news, earnings reports, or economic data.

- Risk/Reward Ratio: Defining a target based on the risk you are willing to take, often aiming for a 1:2 or 1:3 risk/reward ratio.

Role of Chart Time Frames in Trading

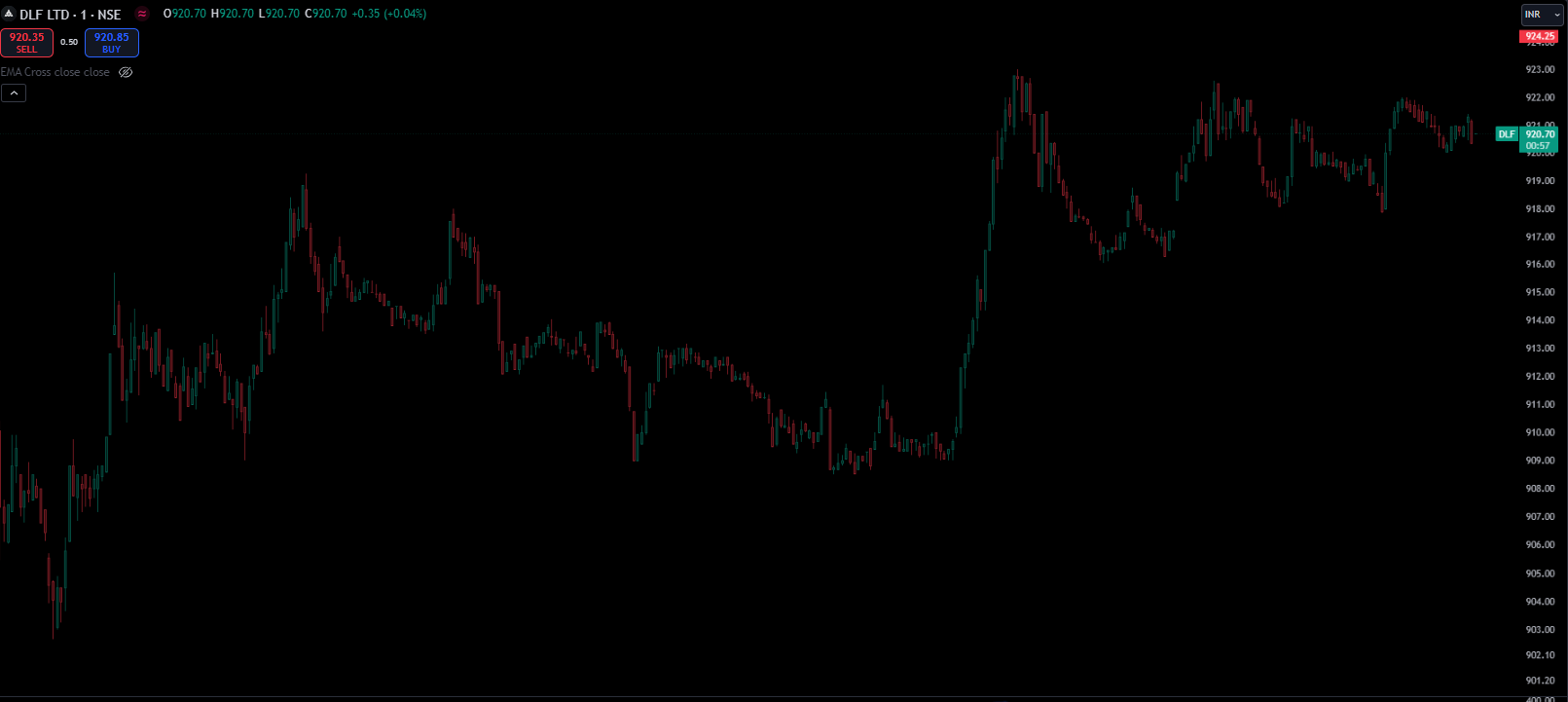

Chart time frames represent how much data is visualized in a single candle or bar on the trading chart. Time frames range from as short as 1 minute to as long as a month. Each time frame has its advantages and disadvantages, depending on the trading strategy you’re employing.

Common Chart Time Frames:

- Short-Term: 1-minute, 5-minute, 15-minute charts, ideal for scalping and day trading.

- Medium-Term: 1-hour, 4-hour charts, commonly used for swing trading.

- Long-Term: Daily, weekly, and monthly charts, preferred by position traders and investors.

How Chart Time Frame Affects Holding Time

The time frame you use has a significant impact on your holding time. Shorter time frames usually lead to shorter holding times, as they capture quick market movements, while longer time frames suggest holding trades over days or even weeks.

Examples of Holding Time Based on Time Frame:

- 1-Minute Chart: Ideal for quick trades that last a few minutes.

- 15-Minute Chart: Day traders might hold positions for 30 minutes to an hour.

- Daily Chart: Swing traders often hold trades for several days, sometimes weeks.

- Weekly Chart: Position traders might hold positions for months.

How to Calculate Holding Time Based on Chart Time Frame

Calculating holding time isn’t an exact science, but it can be estimated using a systematic approach.

Step-by-Step Guide:

- Choose Your Time Frame: Select the chart time frame that matches your trading strategy.

- Identify Market Conditions: Look at the trend, volatility, and potential reversals.

- Use Indicators: Apply moving averages, RSI, or MACD to help time your entry and exit.

- Set a Clear Entry and Exit Plan: Based on support/resistance levels, define when you will enter and exit the trade.

- Backtest: Use historical data to see how long similar trades lasted in your chosen time frame.

How to Set a Target Based on Chart Time Frame

Setting a target requires aligning your profit goals with the chosen time frame.

Steps to Set a Target:

- Define Your Risk/Reward Ratio: Start by deciding how much risk you’re willing to take.

- Use Support/Resistance: Targets should be placed near these levels.

- Apply Technical Indicators: Use tools like Fibonacci levels or Bollinger Bands to fine-tune your target.

- Backtest and Adjust: Test your target-setting method over historical data and adjust accordingly.

Using Technical Indicators for Calculating Holding Time and Targets

Technical indicators are powerful tools to help traders decide on holding time and set realistic targets.

Key Indicators to Use:

- Moving Averages: Help identify the overall trend.

- Relative Strength Index (RSI): Can signal overbought or oversold conditions.

- Bollinger Bands: Help set price boundaries and targets based on volatility.

Common Mistakes in Calculating Holding Time and Target

Many traders make mistakes when calculating holding times and targets, leading to premature exits or missed opportunities.

Common Errors:

- Ignoring Market Conditions: Not adjusting holding time for changing market volatility.

- Overcomplicating with Too Many Indicators: Paralyzing analysis with conflicting data.

- Being Emotionally Driven: Allowing fear or greed to dictate holding time or target setting.

Best Practices for Calculating Holding Time

Proven Strategies:

- Stick to Your Plan: Once you’ve calculated your holding time, avoid emotional deviations.

- Backtest Your Strategy: Testing with historical data will give you more confidence.

- Adapt to Market Changes: Stay flexible and adjust holding times if market conditions shift dramatically.

Best Practices for Setting Targets

Strategies to Keep in Mind:

- Use a Reasonable Risk/Reward Ratio: Aim for at least a 1:2 ratio to ensure long-term profitability.

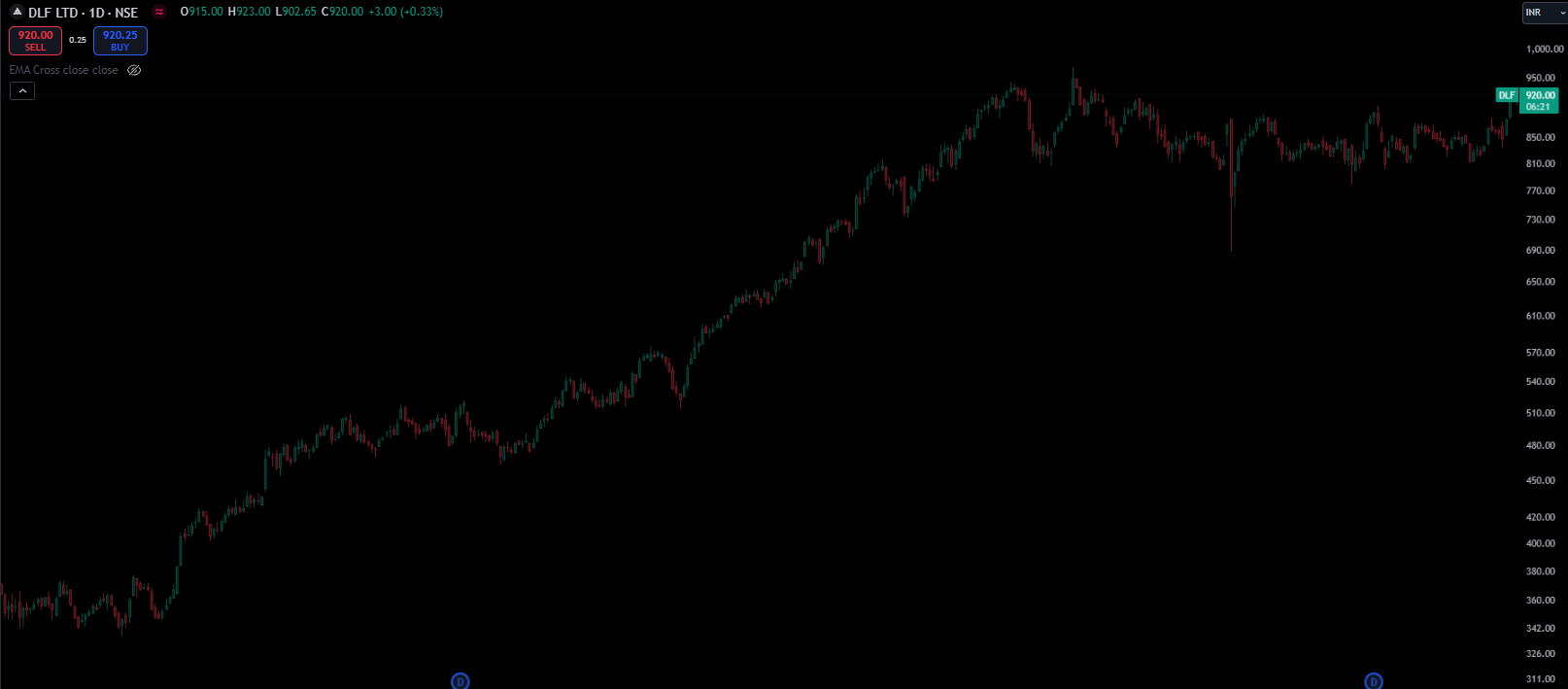

- Align Target with Time Frame: A 1-minute chart should have a smaller target than a daily chart.

- Monitor and Adjust: As the trade progresses, adjust your target if market conditions shift.

Bonus Tips

Which time frame is for how long to hold !!

Monthly Chart : For 6-24 months

Weekly Chart : For 4-12 Weeks

Daily Chart / EOD chart : For 4-10 days

Hourly Chart : For 1-3 days

30 mnts chart : For same day to 1 day

15 mnts chart : For Same Day

5 mnts & 3 mnts chart : For same day

Which time frame is best for which target percentage !!

3 mnts chart target 0.10% to 0.15%

5 mnts chart target 0.20% to 0.30%

15 mnts chart target 0.30% to 0.40%

30 mnts chart target 0.50% to 0.70%

60 mnts chart target 0.80% to 0.90%

120 mnts chart target 1.00% to 1.50% (depends)

Daily chart target 2% to 3% (depends)

Weekly chart target 5% to 10% (depends)

Monthly chart target 15% 50% (depends)

You can follow my social platforms here.

To know more about our content please visit here.

500+ YouTube content. You can subscribe for more live content here.

2200+ Twitter Posting on live proof here.

Follow the Facebook page for updates.