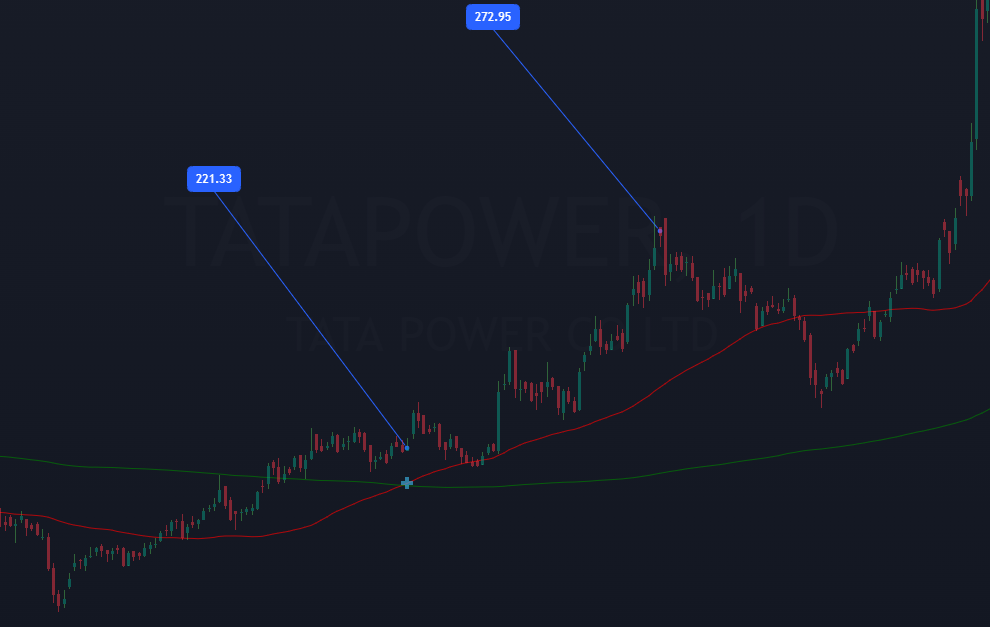

A “golden crossover” is a bullish indicator for the stock market that occurs when a short-term moving average crosses above a long-term moving average. This involves the 50-day moving average (short-term) crossing above the 200-day moving average (long-term). This pattern suggests a potential shift from a downtrend to an uptrend, indicating positive momentum.

Traders or investors view the Golden Cross as a signal to buy, expecting prices to continue to rise. It is often accompanied by higher trading volumes, strengthening bullish sentiment. Golden Cross remains a popular tool for identifying potential long-term uptrend in the stock market.

Mastering the Golden Crossover Strategy

The golden crossover strategy, a popular technical analysis tool, leverages the Simple Moving Average (SMA) indicators, specifically the 50-day and 200-day SMAs. This strategy is highly regarded among traders and investors for its simplicity and effectiveness in identifying bullish market trends. In this comprehensive guide, we will explain the golden crossover strategy and how to use it, and we will talk about its advantages and disadvantages.

Understanding the Golden Crossover

The golden crossover happens when the 50-day moving average goes above the 200-day moving average, showing that the market might go up. On the other hand, a death cross happens when the 50-day moving average goes below the 200-day moving average, suggesting the market might go down.

Why Use SMAs in Trading?

Simple Moving Averages (SMAs) help track the market trend by smoothing out price changes. They reduce random ups and downs in prices, making it easier to see the market’s direction. The 50-day SMA shows the medium-term trend, while the 200-day SMA shows the long-term trend.

Implementing the Golden Crossover Strategy

To use the golden crossover strategy, follow these steps:

1. Set up your chart with a 50-day and 200-day moving average.

2. Watch for the 50-day line to cross above the 200-day line, which is your signal to buy.

3. Confirm the signal with other clues like higher trading volume or candlestick patterns.

4. Buy once the crossover is confirmed and set a stop-loss to manage risk.

5. Keep watching the trade and adjust your stop-loss to secure profits as the trend moves.

Advantages of the Golden Crossover Strategy

Simplicity: The strategy is easy to understand and implement, making it suitable for traders of all experience levels.

Historical Effectiveness: The golden crossover has a track record of signalling significant bullish trends, providing traders with profitable opportunities.

Objective Signals: The crossover points are based on specific price levels, reducing the subjectivity involved in trading decisions.

Limitations of the Golden Crossover Strategy

Lagging Indicator: SMAs are lagging indicators, meaning they reflect past price data. This can result in delayed entry and exit signals.

False Signals: In choppy or sideways markets, the golden crossover can generate false signals, leading to potential losses.

Limited in Short-Term Trading: The strategy is more effective for medium to long-term trading and may not be suitable for short-term traders.

Enhancing the Golden Crossover Strategy

To make the golden crossover strategy better, you can add extra tools:

- Use the Relative Strength Index (RSI) to check if an asset is overbought or oversold, giving more confirmation for your trade.

- Use the Moving Average Convergence Divergence (MACD) to see how strong and in which direction the trend is moving.

- Look at past support and resistance levels to decide the best times to enter and exit your trade.

Real-World Examples of Golden Crossovers

Let’s examine a few historical instances where the golden crossover strategy has proven successful:

Conclusion

The golden crossover strategy, using the 50-day and 200-day moving averages, is a helpful tool for traders to take advantage of rising markets. By learning how it works and its pros and cons, you can use it well in your trades. Always add other indicators and risk management to improve your results and succeed in the long run.

Use the golden crossover strategy to trade in the market with confidence and accuracy.

You can follow my social platforms here.

To know more about our content please visit here.

500+ YouTube content. You can subscribe for more live content here.

2200+ Twitter Posting on live proof here.

Follow the Facebook page for updates.