Introduction to Forex Trading in 2026

Forex trading in 2026 represents a mature, technology-driven financial ecosystem where liquidity, transparency, and speed define success. The global foreign exchange market remains the largest and most liquid financial market, operating 24 hours a day across major financial centres. As participation from retail traders increases, particularly in emerging economies like India, understanding the structure, instruments, and regulations has become essential for sustainable participation.

We approach forex trading as a disciplined financial activity, not speculation. Success depends on preparation, regulatory compliance, and methodical execution.

Understanding the Forex Market Structure

The forex market functions through a decentralised global network of banks, institutions, exchanges, brokers, and traders. Prices are quoted in currency pairs, reflecting the value of one currency relative to another. Trades are executed electronically, with high-frequency price movements influenced by macroeconomic data, interest rates, geopolitical events, and capital flows.

In 2026, algorithmic execution, AI-assisted analysis, and low-latency platforms dominate order flow, making education and infrastructure non-negotiable.

Most Tradable Forex Currency Pairs

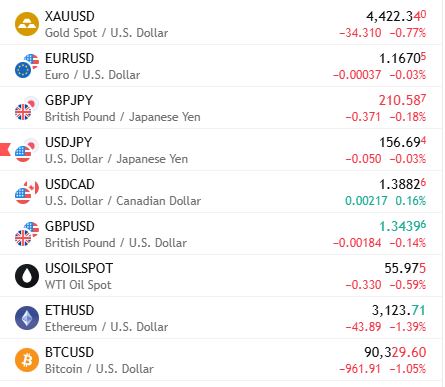

Liquidity and volatility determine tradability. The following pairs remain the most actively traded due to deep liquidity, tight spreads, and consistent market participation:

Major Currency Pairs

- EUR/USD – Highest liquidity, narrow spreads, ideal for technical strategies

- USD/JPY – Strong reaction to interest rate differentials and risk sentiment

- GBP/USD – High volatility, responsive to macroeconomic releases

- USD/CHF – Safe-haven dynamics during global uncertainty

- AUD/USD – Commodity-linked behaviour with Asian market influence

- USD/CAD – Oil-correlated movements and North American liquidity

Cross-Currency Pairs

- EUR/GBP – Stable volatility, policy-driven moves

- EUR/JPY – Trend-friendly with strong momentum cycles

- GBP/JPY – High volatility, suitable for advanced risk management

INR-Based Currency Pairs (India-Compliant)

- USD/INR

- EUR/INR

- GBP/INR

- JPY/INR

These INR pairs are legally tradable on Indian exchanges and form the foundation for compliant forex participation in India.

Forex Trading Conditions in India (2026)

India maintains a regulated forex environment under the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Compliance is mandatory.

Permitted Trading Framework

- Indian residents may trade currency derivatives on recognised Indian exchanges such as NSE and BSE

- Trading is allowed only in INR-based pairs

- Contracts are standardised and settled in INR

Restricted Activities

- Trading foreign currency pairs (e.g., EUR/USD, GBP/USD) through overseas brokers is not permitted for resident Indians

- Margin trading with unregulated offshore platforms violates FEMA guidelines

Legal Instruments Available

- Currency futures

- Currency options

- Exchange-cleared contracts with transparent margin requirements

Adhering to these rules protects capital and ensures long-term participation without regulatory risk.

Choosing the Right Trading Platform

A reliable trading platform in 2026 must provide speed, security, analytics, and compliance. We prioritise platforms offering:

- Exchange connectivity (NSE/BSE)

- Real-time market data

- Advanced charting tools

- Risk controls and margin transparency

- Seamless order execution

Technology is no longer optional. Execution quality directly impacts profitability.

Capital Allocation and Risk Management

We approach forex trading with defined capital allocation and controlled exposure. Risk management is embedded in every decision.

Core Principles

- Risk no more than 1–2% per trade

- Use predefined stop-loss and target levels

- Maintain a favourable risk–reward ratio

- Avoid over-leveraging despite available margins

In 2026, professional traders focus on capital preservation first, growth second.

Trading Strategies That Work in 2026

Market conditions evolve, but structured strategies remain effective when applied with discipline.

Trend-Following Strategies

- Identify higher timeframe direction

- Enter on pullbacks using technical confluence

- Best suited for USD/INR and EUR/USD behaviour models

Range and Mean-Reversion Strategies

- Effective during low-volatility sessions

- Use support and resistance with volatility filters

News and Event-Based Trading

- Central bank decisions

- Inflation, GDP, and employment data

- Requires fast execution and predefined risk

We emphasise strategy consistency over frequency.

Technical and Fundamental Analysis Integration

Successful traders in 2026 integrate technical precision with macro awareness.

Technical Tools

- Moving averages

- Volume profiling

- Momentum oscillators

- Price action structures

Fundamental Drivers

- Interest rate policies

- Inflation trends

- Fiscal and trade balances

Combining both enhances decision quality and timing accuracy.

Psychology and Trading Discipline

Forex trading rewards emotional control and patience. We operate with predefined rules, avoiding impulsive decisions driven by short-term fluctuations.

Key psychological practices include:

- Maintaining a detailed trading journal

- Reviewing performance objectively

- Accepting losses as part of the process

Consistency outperforms intensity.

Taxation and Compliance in India

Profits from currency derivatives in India are treated as business income or speculative income, depending on the instrument. Proper record-keeping and professional tax advice ensure compliance.

We prioritise transparent accounting and regulatory adherence as part of responsible trading.

Conclusion: Building a Sustainable Forex Trading Journey

Starting forex trading in 2026 requires a structured approach grounded in regulation, education, technology, and discipline. By focusing on compliant instruments, liquid currency pairs, robust risk management, and continuous learning, we position ourselves for long-term participation in the global currency market.

Forex trading is not about shortcuts. It is about precision, preparation, and professionalism.

For more content, you can check here.

You can follow my social platforms here.

500+ YouTube content. You can subscribe to more live content here.

2200+ Twitter postings on live proof here.

Follow the Facebook page for updates.