Introduce the concept of 1-minute chart trading: Start by explaining that 1-minute chart trading is a short-term trading strategy where you make quick decisions based on the price movements observed in 1-minute candlestick charts.

Importance of selecting the right stochastic settings: Emphasize that in this fast-paced trading environment, using the right settings for technical indicators like the stochastic oscillator is crucial.

Understanding Stochastic Oscillator

The basics of the stochastic oscillator:

Start by introducing the stochastic oscillator as a technical analysis tool commonly used by traders. It’s used to identify potential trend reversals or overbought/oversold conditions in the market.

The significance of stochastic in technical analysis:

The role of the stochastic oscillator in helping you make informed decisions. It’s particularly valuable for short-term or intraday traders focusing on 1-minute charts.

Highlight its relevance in short-term trading:

Emphasize that the stochastic oscillator is especially useful for traders looking to profit from short-term/intraday price movements, such as those on 1-minute charts. Its sensitivity to price changes makes it valuable for quick decision-making.

Why Stochastic Settings Matter in 1-Minute Chart Trading

The specific reasons why selecting the right stochastic settings is of paramount importance when engaging in 1-minute chart trading. Here’s a breakdown:

Explain why 1-minute charts require unique settings:

Start by highlighting that trading on 1-minute charts differs from trading in longer timeframes like daily or weekly charts. Rapid price movements on 1-minute charts necessitate different settings for technical indicators, such as the stochastic oscillator.

The challenges and advantages of trading in such a short time frame:

The benefits and difficulties associated with 1-minute chart trading are very interesting. A short time frame is always good for any type of scalping, but here are some major things that cannot be ignored when executing the trade. Every short-time trader naturally uses a major quantity for quick profit booking. In this way, they try to make money. But always need to remember to use strict stop loss where you can save your money. In a 1-minute time frame, you can see major noise which can affect your trading psychology. So, be prepared before executing a trade in a short time frame.

Default Stochastic Settings

Here we are going to explain the parameters that need to be used for the best outcome. The default Stochastic settings are 5, 3, 3. Also, some other traders used settings for Stochastic including 14, 3, 3, and 21, 5, 5.

These settings often include a period of 14 for %K, a period of 3 for %D, and overbought and oversold levels set at 80 and 20, respectively.

Practical Tips for 1-Minute Chart Trading with Stochastic

Trading with a 1-minute chart using the stochastic oscillator requires precision, discipline, and quick decision-making. Here are some practical tips to help you succeed:

1. Understand Stochastic Basics

Measures the momentum of price movements. It ranges from 0 to 100 and consists of two lines: %K (the current closing price relative to the high/low range over a specific period) and %D (a moving average of %K). Stochastic values above 80 indicate overbought conditions, while values below 20 indicate oversold conditions. However, in a strong trend, these levels can be misleading, that’s why you have to prepare for this.

Use supporting tools for more strong confirmation. Major of the traders preferred the Moving Average for best confirmation.

Here also you can find some future candle wicks or you can check the support and resistance line. Identify key support and resistance levels. A stochastic signal near these levels can be more reliable.

Don’t jump into a trade as soon as the stochastic hits overbought or oversold levels. Wait for the %K line to cross the %D line as confirmation.

The 1-minute chart requires quick decisions. Set predefined profit targets and stop-loss levels to avoid being caught in sudden reversals.

Given the volatility of 1-minute charts, keep your position sizes small to manage risk.

Set stop-loss orders close to your entry point to minimize losses. A 1-minute chart can move rapidly, so be prepared for quick exits.

Economic news releases or unexpected events can cause significant price swings. Avoid trading around these times unless you are specifically trading the news.

Constantly monitor the market for any signs of unusual activity that could impact your trades.

Have a trading plan and stick to it. Don’t let emotions dictate your trading decisions.

Test your strategy on historical data to understand how it performs under different market conditions. This helps in refining your approach.

Test your strategy on historical data to understand how it performs under different market conditions. This helps in refining your approach.

1-minute chart trading can be stressful. Stay calm, and avoid over trading. Stick to your strategy, and take breaks if needed.

Bonus Tips (Divergence)

This occurs when the price makes a new low, but the stochastic makes a higher low. This can signal a potential reversal upward.

Occurs when the price makes a new high, but the stochastic makes a lower high. This can signal a potential reversal downward.

2. Use Stochastic in Conjunction with Other Indicators

3. Focus on Divergences

4. Time Entries and Exits

5. Manage Your Risk

8. Use a Reliable Platform

By following these tips, you can use the stochastic oscillator to enhance your 1-minute chart trading strategy and improve your chances of making successful trades.

Real-life Examples

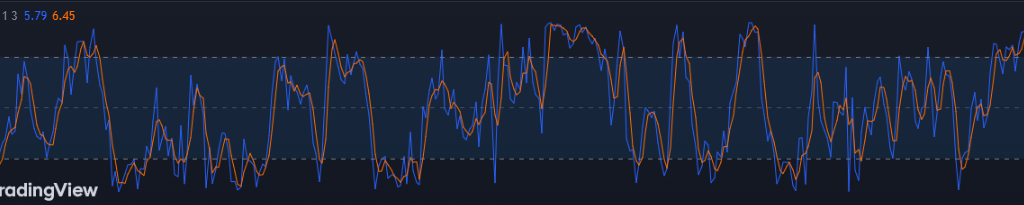

Here, we will showcase real trading scenarios and examples that demonstrate the practical application of the optimized stochastic settings on 1-minute charts.

In this above chart, you can see stochastic showing an oversold zone consolidation phase. Price was also on the downside. If you check the stochastic very carefully, you can see some upside directions against the price direction. Price was falling sharply, but stochastic was not react as per price. This is called a positive divergence which indicates a proper outbreak from the situation. Here price found the Smart money and built up a strong recovery direction.

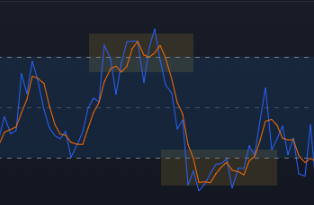

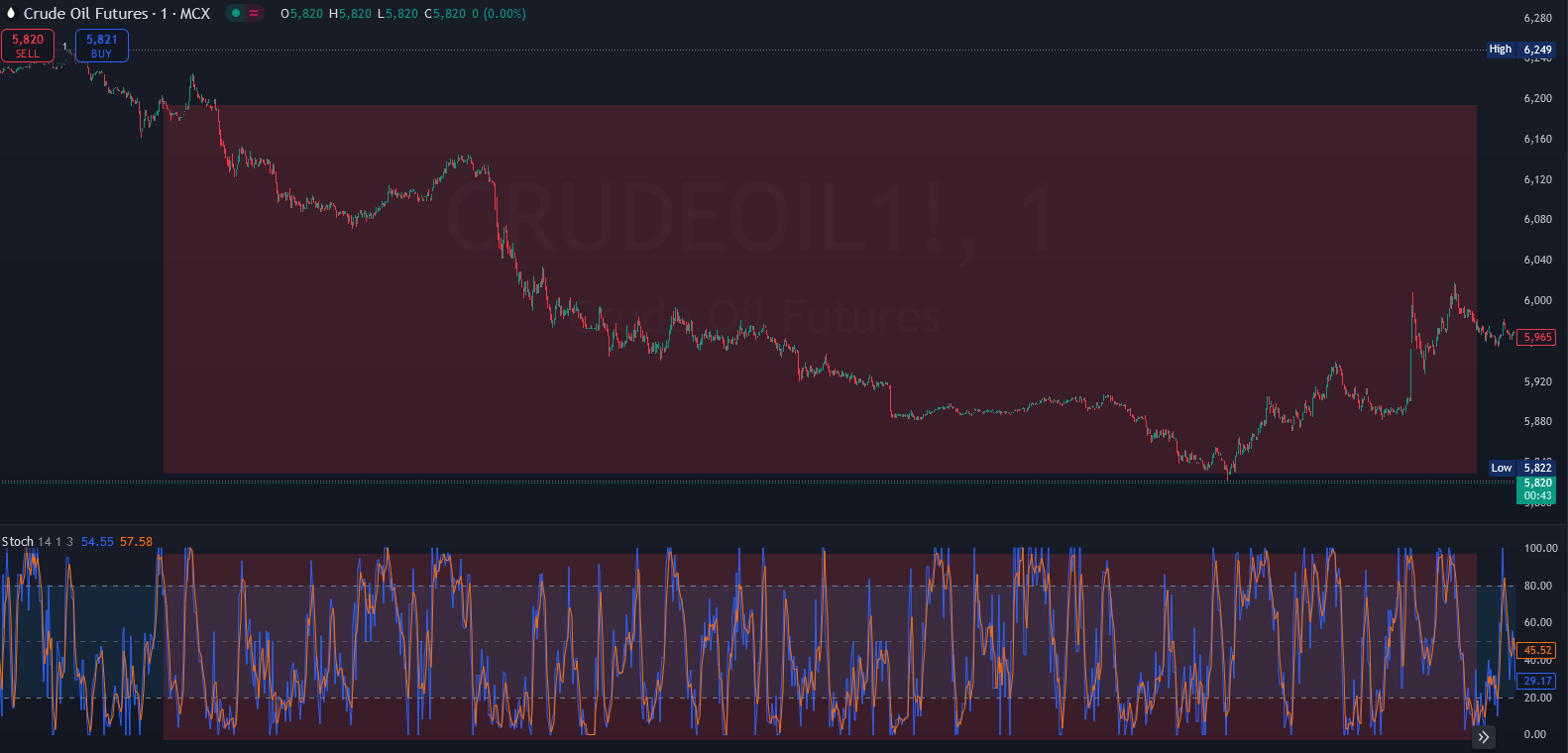

Another real example gives you some next-level view to judge a trade. In this above chart, you can see stochastic showing an extreme oversold zone. This was a CRUDEOIL chart over a 15-minute timeframe. This stochastic showing is very choppy below its 80 zone. Sometimes it crossed the 80 line and then failed to establish the reversal trend. Now check the below picture: –

This is a 15-minute timeframe chart and check the stochastic. It’s showing like up and down phase. 15-minute chart showing only below 80 zones and a 1-minute chart showing some extreme levels up & down between 80 & 20.

Now add some twist. Adding 34 SMA. Now Let’s check out the chart.

Here you can see more scalping opportunities than the 15-minute chart. Let’s check some real trade stories from this chart.

Simple Manual Rules from my END:-

First, change the stochastic settings which follow 5,3,3. We have already added SMA 34.

What is our Basic concept of stochastic ?? Do you remember ?? Forgot ???

Don’t worry. I am here to point this out again. Above the 80 zones the price will be bullish and below the 20 zone price will be bearish. So, We will follow the rules but with the help of SMA, we will execute the trade.

If the price is above the SMA 34 value and at stochastic is above the 80 line, buy with Stop loss which will be the last spike low. Follow the below chart for reference.

Now the question is what will be the target?

In my opinion, this is critical to book profits on a scalping trade. There is no proper technical way to book profits because of fast-moving prices. As a scalper, you must constantly watch the price and book profits as per your comfort. The best way to revise your stop loss in every candle move is to get healthy profits or minimize your loss.

Conclusion

Scalping trading or 1-minute trading, is the most used trading concept in the world market. In the Indian market, major of the option traders used scalping trading for the best return. Most option traders use big quantities with a small range of points to take the risk. They also use a tight stop loss to protect their capital. So, stop loss is a must to be used for scalping or 1-minute trading. Build a proper strategy and run a demo test on various platforms to ensure the probability of ROI.

Let’s start investing today and consult your financial advisor for a better proposal.

For more content, you can check here.

You can follow my social platforms here.

500+ YouTube content. You can subscribe for more live content here.

2200+ Twitter Posting on live proof here.

Follow the Facebook page for updates.